Using the formula, the gross margin ratio would be calculated as follows: Gross Margin Ratio = (Revenue – COGS) / Revenue The remaining amount can be used to pay off general and administrative expenses, interest expenses, debts, rent, overhead, etc. The ratio indicates the percentage of each dollar of revenue that the company retains as gross profit.įor example, if the ratio is calculated to be 20%, that means for every dollar of revenue generated, $0.20 is retained while $0.80 is attributed to the cost of goods sold. It shows how much profit a company makes after paying off its Cost of Goods Sold (COGS). However, if companies want to calculate their sales tax and GST, they can effectively use GST calculator and Sales Tax calculator to avoid any inconvenience.The Gross Margin Ratio, also known as the gross profit margin ratio, is a profitability ratio that compares the gross margin of a company to its revenue. For instance, if a company needs to achieve 25% profit margin, it can use this calculator and check the profit volumes. This calculator can be used effectively by companies to project profit amounts. For instance, if the cost is 1500 and revenue is 2000, margin percentage would be 25, profit will be 500 and markup would be 33.33%. The outputs include margin percentage, profit amount and markup percentage. The tool would incorporate the input values and then determine the results.After that, the cost and revenue figures need to be entered. If gross profit has to be calculated, it needs to be selected from the drop down menu.This calculator helps with accurate margin calculation. Now, simply insert these values in the formula written above. It means that the cost of producing goods is $ 130 ($150 - $20). The formula for calculating gross margin is very similar to profit margin.Ĭonsider that a financial firm earns a profit of $20 and the total revenue generated is $150. Profit Margin = (Revenue – Cost of Goods Sold) / Revenue * 100 Hence, we need to insert these values in the formula mentioned above.

On the basis of these details, the profit margin has to be determined. The cost spent on producing the goods is $60. (Revenue – Cost of Goods Sold) / Revenue * 100 (The profit margin is expressed in percentage).įor better understanding, we need to use the gross profit margin formula written above through an example.Ĭonsider that there is a firm which has earned a revenue of $100.

The formula for profit margin is given as Some firms check the margin for each investment while the others perform this check annually.Įarnings per share and percentage calculators are also widely used among companies to calculate share and percentages respectively.

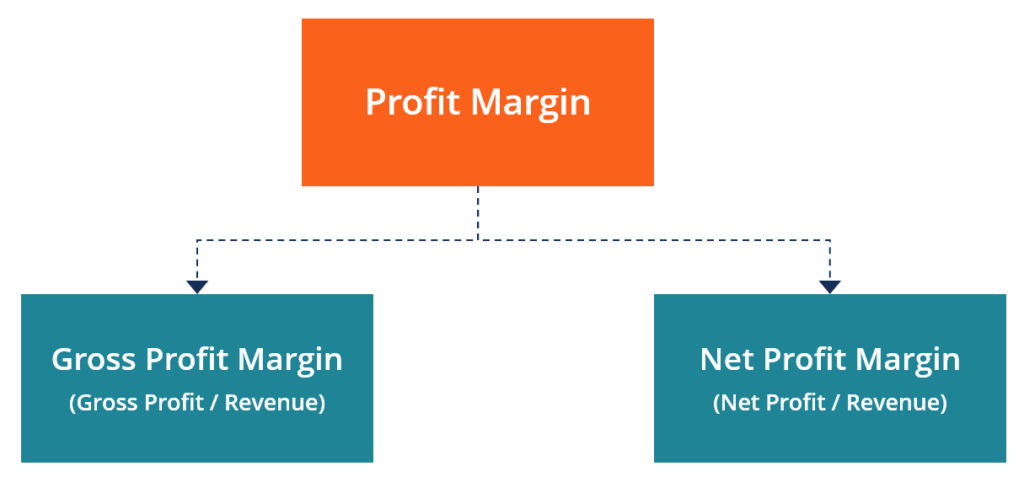

However, a positive margin value shows that a company is on a profitable route. If the value of margin is negative, it means that the company is facing losses and a zero profit margin gives the impression that there are no profits or losses. When one company plans to purchase a firm or take managerial control, it checks the profit margin. Profit Margin is used for various financial purposes including checking the financial state of a company.When the value of margin is determined, it is taken as a ratio of revenue and the results is multiplied by 100. This difference is expressed as a percentage of revenue. In simple terms, margin is the difference between the revenue a company has earned and the cost of goods sold.

These two parameters are also used in calculation of profit margin. The total revenue that a company earns includes the cost involved in producing the goods (Cost of Goods Sold). The gross profit margin calculator provides assistance for calculating profit margin.

0 kommentar(er)

0 kommentar(er)